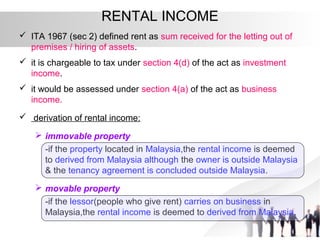

Income from the letting of real property in Malaysia is named as rental income and is chargeable to tax under section 4d of the Income Tax Act 1967. In order to promote affordable accommodation to the.

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

All the facilities.

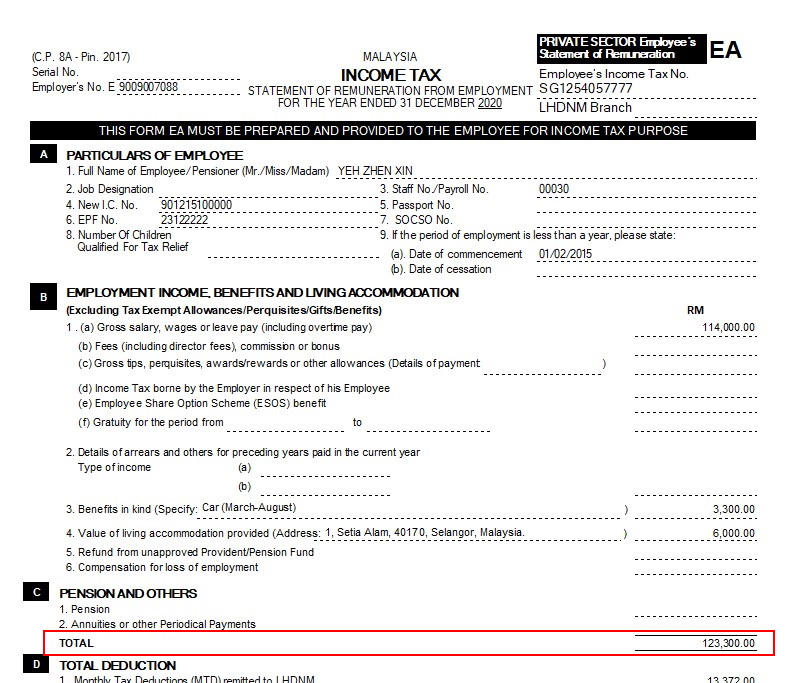

. The government of Malaysia is offering 50 income tax exemptions for three consecutive years 2018 2020 to individuals who rent out their residential properties at a rate not exceeding RM 2000 per month for each property. According to Thannees Tax Consulting Services Sdn Bhd managing director SM Thanneermalai there are two types of rental income namely passive and business income. This is after EPF deductions.

Income Tax Special Deduction for Reduction of Rental to a Tenant other than a Small and Medium Enterprise Rules 2021 PUA 3542021 A 3542021 These Rules apply to landlords who rent out business premises to any tenant who is a Malaysian-resident carrying on his business at the business premise. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30. Any person whether resident or non-resident citizen or non-citizen individual or not who derives rental income from Malaysia is thus subject to income taxThe type of person or the residence status of the person determines the.

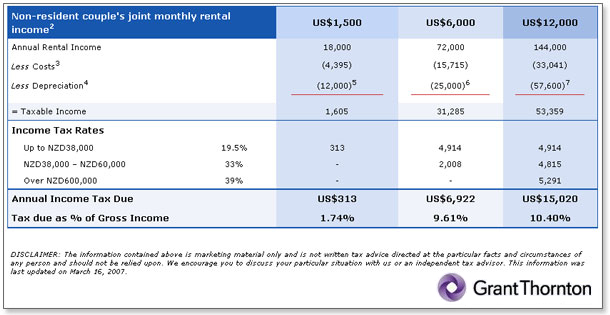

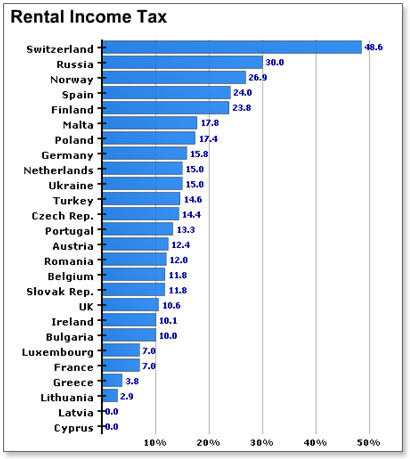

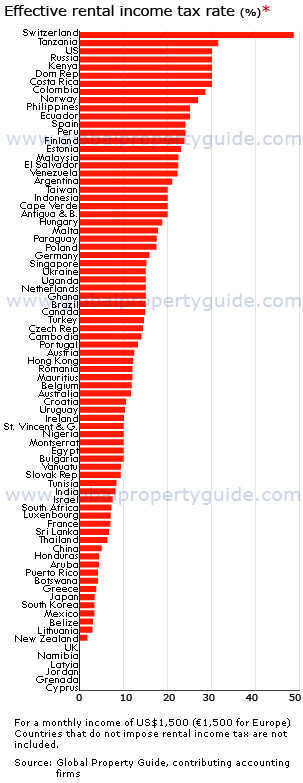

Rental income taxes. The tax levied on the average annual income on a rental apartmentproperty in the country. Depreciation does not qualify for tax deductions.

Gross rental income is US1500month. Rental income is taxed at a flat rate of 24. We assist all clients in managing their.

For the resident the tax rate will be. Rental income is generally assessed under Section 4 d Rental Income of the Income Tax Act and is seen as income from investment. 2 Exchange rate used.

100 US 400 MYR. As an example lets say you have leased out your condominium unit with a monthly rental of RM1000 for a one-year tenure. 12004 Log in Upload File.

RM 23150 x 28 RM 6482. Azrie owns 2 units of apartment and lets out those units to 2 tenants. Total to tax to pay.

If your rental income is considered as a non-business income you will need to add the amount youve generated from the rental to your total income. Income-generating expenses are deductible from the gross rent such as interest expense cost of repairs assessment tax quit rent and agents commission. If the tenancy agreement starts from January 2021 you will.

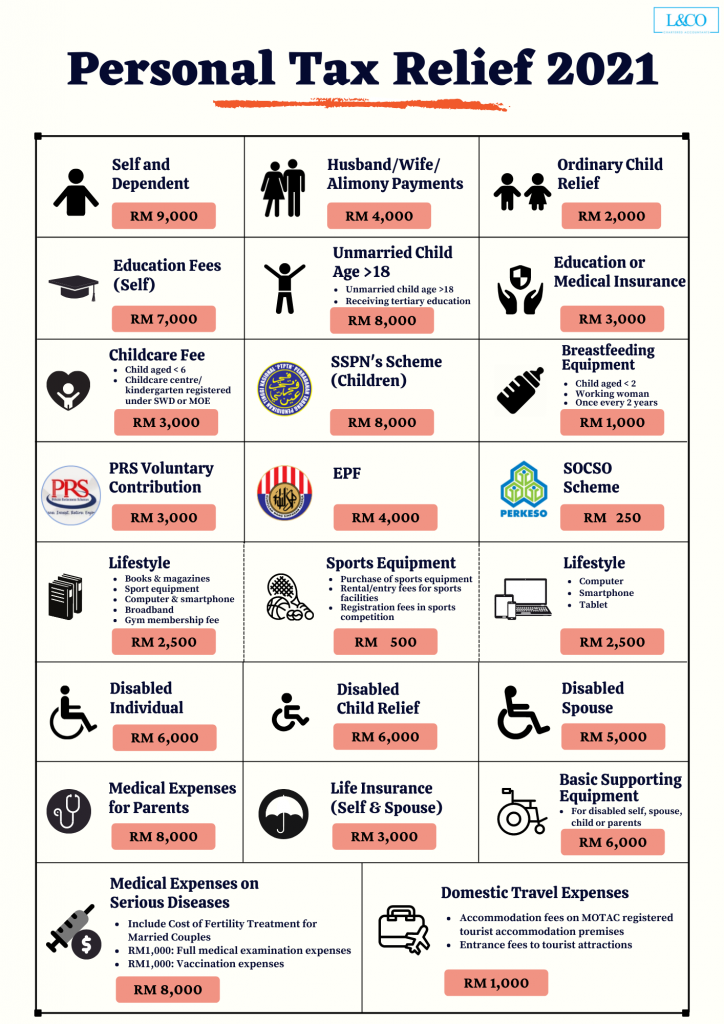

Payment for accommodation at premises registered with the Commissioner of Tourism and entrance fee to a tourist attraction expenses incurred on or after 1 March 2020 until 31 December 2021 1000. You will only need to pay tax if. The tenants are entitled to use the swimming pool tennis court and other facilities that are provided in the apartment.

1 The property is jointly owned by husband and wife but then taxed separately 50 upon each partner. The date of commencement of renting is on the first. Prior to Jan 1 2018 all rental income was assessed on a progressive tax rate ranging from 0 to 28 without any tax incentive or exemption.

Nonresidents are taxed at a flat rate of 24 on their Malaysian-sourced income. When rental income is assessed under section 4 d it has to be grouped into three sources namely residential properties commercial properties and vacant land. Passive rental income is filed under Section 4 d of the Income Tax Act 1967 ITA.

LEMBAGA HASIL DALAM NEGERI INLAND REVENUE BOARD PUBLIC RULING INCOME FROM LETTING OF REAL PROPERTY Translation from the original Bahasa Malaysia text. Tax chargeable on the rental Income will be. Income-generating expenses such as quit rent assessment repairs and maintenance fire insurance service charge sinking fund and management fees are deductible.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Income received from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ITA. For the first RM 20000 tax to pay is RM 475.

Your net rental income is derived after deducting the amount you have spent on the propertys upkeep as listed above. Amount RM Individual chargeable income less than RM35000. Malaysia tax on rental income.

For non-resident tax rate chargeable will be. The property is personally directly owned jointly by husband and. How to calculate net rental income.

The amount of income you earn exceeds RM34000 per Annum and if you break it down to per month around RM283333. For every RM 1 above will be 7 tax to pay is RM 220. In Malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d Rental income of the Income Tax Act 1967.

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Financing And Leases Tax Treatment Acca Global

Financing And Leases Tax Treatment Acca Global

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Personal Tax Relief 2021 L Co Accountants

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Special Tax Deduction On Rental Reduction

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

German Rental Income Tax How Much Property Tax Do I Have To Pay

Taxation Principles Dividend Interest Rental Royalty And Other So

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Global Rental Income Tax Comparison

8 Things To Know When Declaring Rental Income To Lhdn